platform

Argiro represents the pinnacle of credit management solutions, designed to revolutionise your banking experience and streamline credit operations. Our platform delivers a transformative experience for employees and customers by providing a one-stop shop for all your credit management needs.

Argiro is committed to advancing in-depth credit risk management to protect shareholders' capital and minimise losses through proactive strategies and deep industry insights. We empower you by educating your bankers on risk appetite and embedding policies in process, ensuring robust credit risk management across financial institutions, whether you're an international bank or an SME.

With our API-driven integration and seamless data handling capabilities, Argiro turns your data into a valuable asset, streamlining processes and unifying wholesale customers onto a single, efficient platform.

Let Argiro elevate your credit process by integrating risk management, and automating loan fulfilment whilst delivering unparalleled performance tailored to your needs.

Transform

Value proposition

The Argiro credit platform is more than a software solution; it's a strategic tool designed to centralise and digitise credit management from deal origination, credit approval, fulfilment and ongoing risk monitoring.

By integrating deal origination, decision support, workflow management, and financial intelligence within a single, cohesive platform, Argiro eliminates the silos and inefficiencies that hinder progress. This unified approach not only accelerates decision-making but also ensures transparency and accountability at every step.

Rooted in values of empathy, collaboration, accountability, respect, and curiosity, Argiro represents a commitment to excellence and continuous improvement. We understand the complexities and challenges of modern banking, and we're dedicated to creating solutions that empower banks and their customers.

Join us in redefining

credit management.

Discover how Argiro can simplify your processes, enhance customer relationships, and drive sustainable growth for your institution.

Together, let's shape the future of banking where credit management meets digital simplicity and human connection.

Argiro platform overview

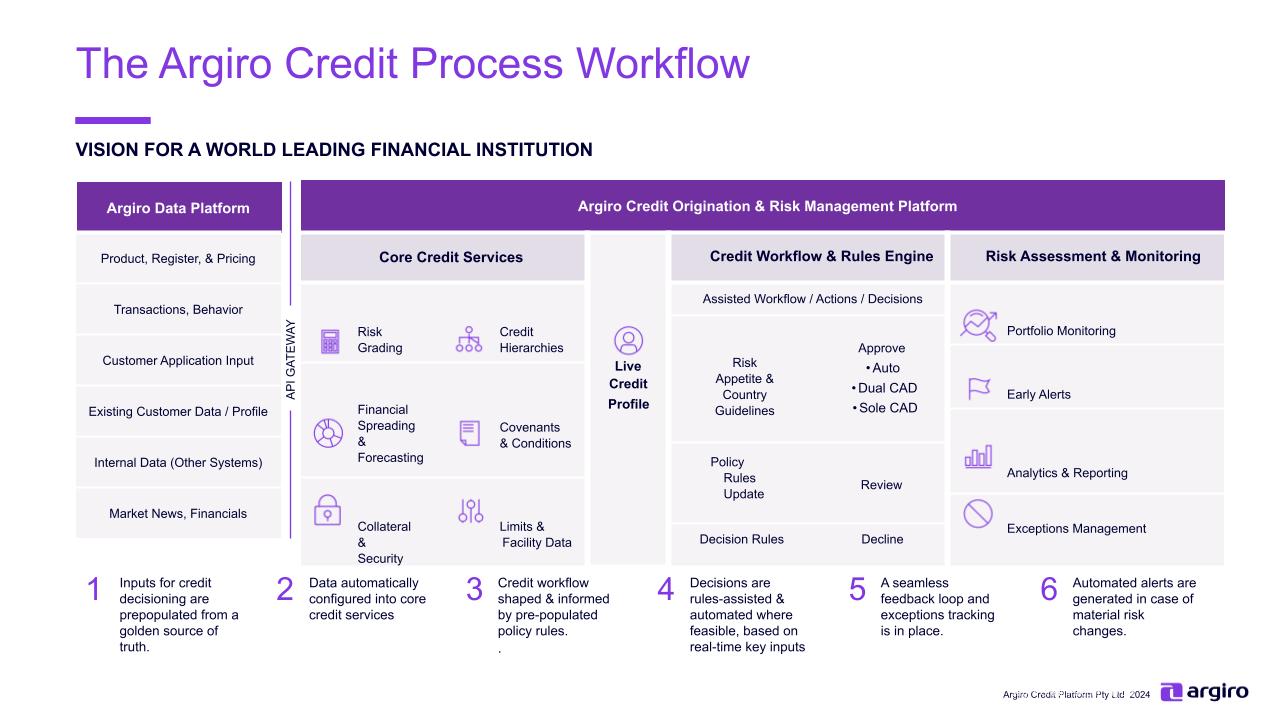

The Argiro credit platform is designed for the credit management stage of a customer journey. When a deal has been identified with a customer, bankers can use Argiro’s modules and credit memo workflow to assess and approve the deal more quickly. After a deal is approved, the platform can be used to continually manage and monitor the risk across the portfolio.

Benefits

The Argiro approach: revolutionising a Tier 1 bank

These are the kinds of results you can expect with the Argiro approach, as experienced by a major bank:

The Argiro credit platform works on a micro-services pattern. These micro-services are independently functioning modules that can be deployed on an infrastructure of choice for the customer. The platform can be deployed as full software as a service (SaaS) and on a bank's existing premises and server infrastructure.

The cloud native and on-premises front-end solution can work seamlessly with all back-end applications such as core banking, CRM, and risk engines. It supports onboarding for small business, commercial, corporate, large institutional segments, and multiple product lines.

It offers customisation and configuration capabilities to design customer-centric, end-to-end digital credit processes with standardised, streamlined management of credit origination and monitoring. An extensive set of APIs enable delivery of personalised experiences across all micro-services, enabling a desktop experience for the banker that is tailored to each function across the value chain. Its data architecture offers a robust foundation for insights-driven banking.

- Layered architecture

- Real-time data processing and embedded insights

- Unified data model, designed with domain-based data marts

- Interactions based on APIs and events