For Banks and other Lenders

AI-powered credit and risk solutions built for modern banking

We work with global tier one and regional banks to transform how they manage origination, credit workflows and risk management.

Argiro simplifies credit origination, streamlines loan management, and ensures your teams can respond faster, with better risk insights at every step.

What we help you do:

- Accelerate credit and lending decisions with intelligent automation

- Reduce manual processes and administrative overhead

- Meet APRA and CPS 230 obligations with integrated oversight

- Cut credit risk and unlock more time for high-value portfolio work

- Argiro is ISO 9001 certified, ensuring quality and consistency in how we deliver, scale and support enterprise-grade solutions.

Revolutionise employee and customer experiences

Discover how our cutting-edge technology and services can empower your team and drive your success

For Corporates and MNCs

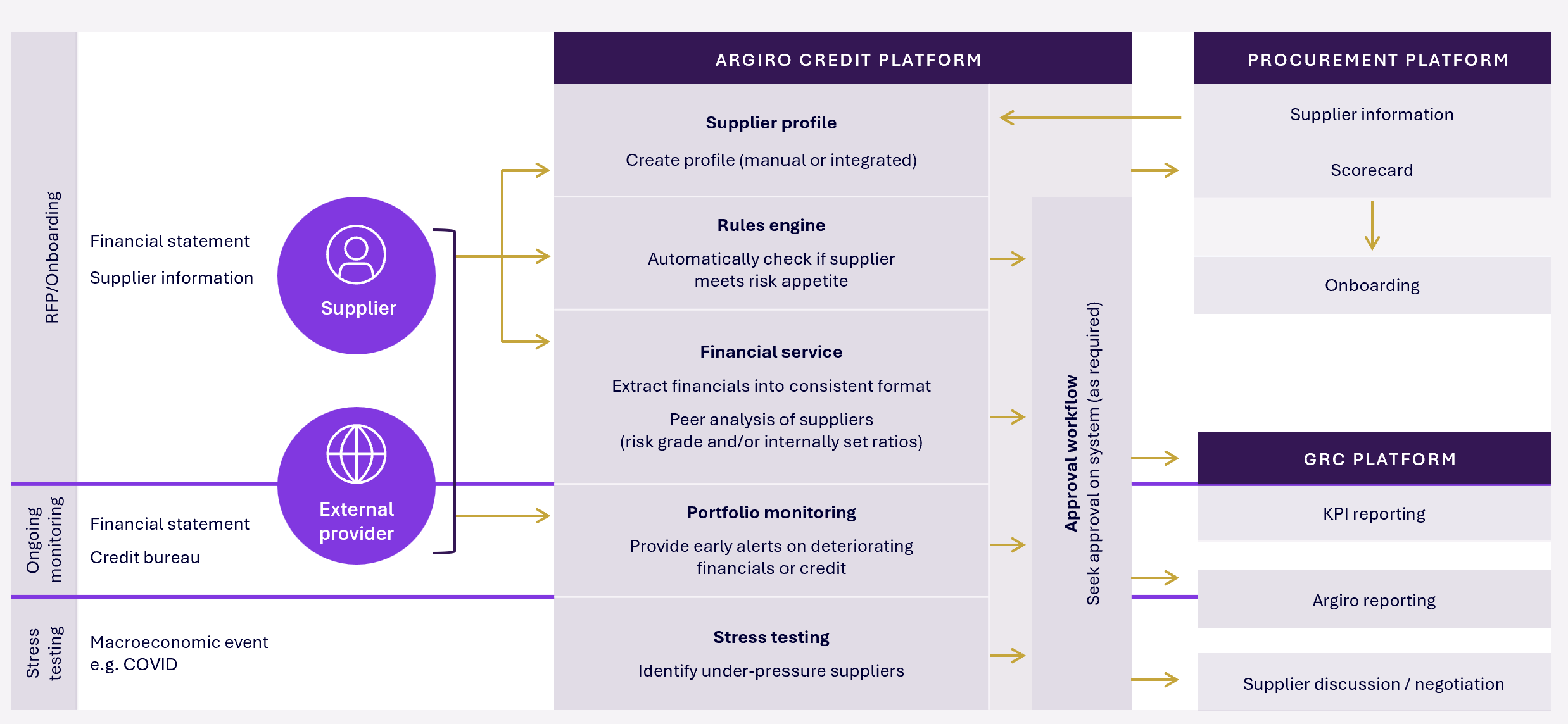

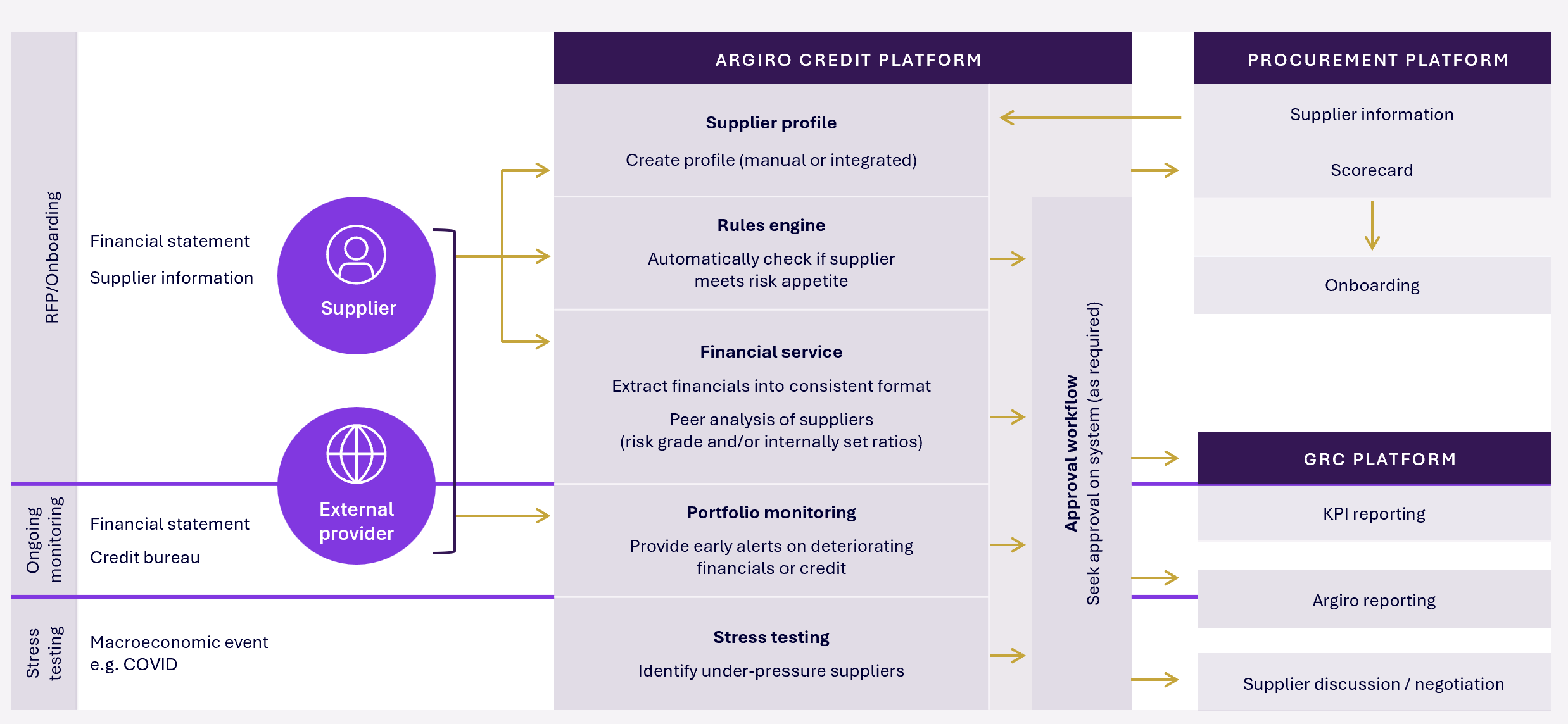

Resilience starts with visibility — Argiro for risk and supplier management

Large corporates, multinationals and non-financial institutions need to manage third-party risk with the same precision as banks — especially with CPS 230 taking effect 1 July 2025.

Argiro provides a centralised platform to track supplier creditworthiness, automate compliance monitoring, and respond proactively to emerging risks.

What we help you do:

- Manage financial and operational resilience across your customer and supplier ecosystem with a bank grade credit platform

- Replace fragmented spreadsheet processes with real-time oversight

- Assess supplier risk, concentration and financial health at a glance

- Stay ahead of CPS 230 obligations across procurement and supply chain

- Optimise operational risk management without heavy internal lift

- Argiro is built on a Multi-cloud strategy with its AI models remaining private, never shared, never used to train models and never accessible to any third parties

- Book a call to explore how we can support your team